"When China wakes up, she will shake the world." This famous prediction of Napoleon has been confirmed by history. Particularly in the last 20 years, China has become an economic power of primary importance that objectively threatens the world leadership of the United States.

But now, for the first time, Beijing will no longer be a buffer against world recession (as it was after the 1990s and until very recently) but one of its triggers. Now the question is not just "How will China enter the impending world recession?", but, above all, "how will it come out of it?"

Trade

Donald Trump's trade war with China is no joke. In December, it caused a 63 percent fall in US imports from China and, at the same time, there was a collapse of foreign direct investment towards Beijing. In November, it was 26.3 percent, according to data from the Ministry of Commerce, and this continued in the following months, although at less-devastating levels. The value of stocks on the Shanghai Stock Exchange has also fallen by 20 percent in the same period.

However, the most interesting data, as observed by Il Sole 24 Ore, is that "a dramatic fall in private investments" and a "substantial recovery in the investments of state companies" were already underway, in conflict with what had previously been decided.

Donald Trump's trade war caused a 63 percent fall in US imports from China in December 2018, and a collapse of foreign direct investment towards Beijing / Image: Socialist Appeal

Donald Trump's trade war caused a 63 percent fall in US imports from China in December 2018, and a collapse of foreign direct investment towards Beijing / Image: Socialist Appeal

In other words, they had to plug the crisis through state spending, and avoid the risk of contagion, given that, as the World Bank writes, "China is deeply integrated into the global economy". Suffice it to say that China's investments represent one-fifth of global investments, and account for 42 percent of the recovery after the crisis in 2010-15.

The decline in Chinese private investment raises serious concerns, on the part of the government, over the country's GDP growth prospects. China's potential growth is expected to decrease from its previous 10.6 percent in 2010 to 6 percent in 2020. Today, it is officially at 6.4 percent. This may seem positive by European standards, but with a 4 percent population growth and internal mobility of tens of millions of Chinese who move from the countryside to the cities every year looking for a job, this figure is considered to indicate a stagnant economy, and moreover is destined to worsen.

A sea of debt

Furthermore, the Chinese economy is beginning to drown in a sea of debt, as was the case in all the historically advanced countries of world capitalism in recent years, with the difference that Beijing has accumulated its debt over a much shorter period of time.

According to the International Monetary Fund (IMF), Chinese state debt has reached US$6 trillion, while the total overall debt (which also includes household, private and bank debts) stands at the astronomical level of US$23 trillion.

As we will see, despite the efforts undertaken by Xi Jinping to reach an agreement with the US on trade, it is unlikely that these will have a lasting positive impact. The pressure is bound to increase.

In the face of numerous declarations that go in the direction of détente between the two countries, the facts tell a different story. Huawei, China's largest telecommunications company, is preparing a billion-dollar lawsuit against the US government. Certainly, the US request for the Canadian authorities to put Meng Wanzhou, the financial director (as well as the founder's daughter) of the Chinese giant under house arrest cannot be considered an act of reconciliation towards Beijing.

Pressure from the US and the European Commission against the Italian government is becoming more and more aggressive. Italy has been accused of acting as a Trojan horse, favouring the penetration of Chinese products into the European market by joining the One Belt, One Road, also known as the "New Silk Road" initiative.

During Chinese President Xi Jinping's recent visit to Italy on 22 March, Italy officially signed up to the Chinese mega-project. What we see here is China's new role and the level of the conflict that is maturing on an international scale.

Overproduction

China has a desperate need to widen its commercial outlets, as it has been overproducing for some time, even though the Xi Jinping government has gone beyond the "natural laws" of capitalism and has continued to invest impressive amounts as a measure to artificially support the economy.

This policy of credit expansion (which economists call quantitative easing), which all the central banks in the world overdid after the 2008 crisis, is being used less and less, for the simple reason that it no longer has an effect, as Bloomberg confirmed recently (01/17/2019).

The Fed, the American central bank, abandoned it more than a year ago, followed by the ECB in January of this year. In Japan, it has had no effect for at least a decade.

Now it is China’s turn to find itself in a paradoxical situation, as only a part of the gigantic debt that it has accumulated has served to develop new industrial technologies and infrastructures, while a substantial part has gone to support the national currency and defunct public enterprises that can no longer survive on their own within the market. This is for the simple reason that, if the Chinese government had acted any differently, it would have added to unemployment created by private companies carrying out tens of millions of redundancies in the state-owned companies.

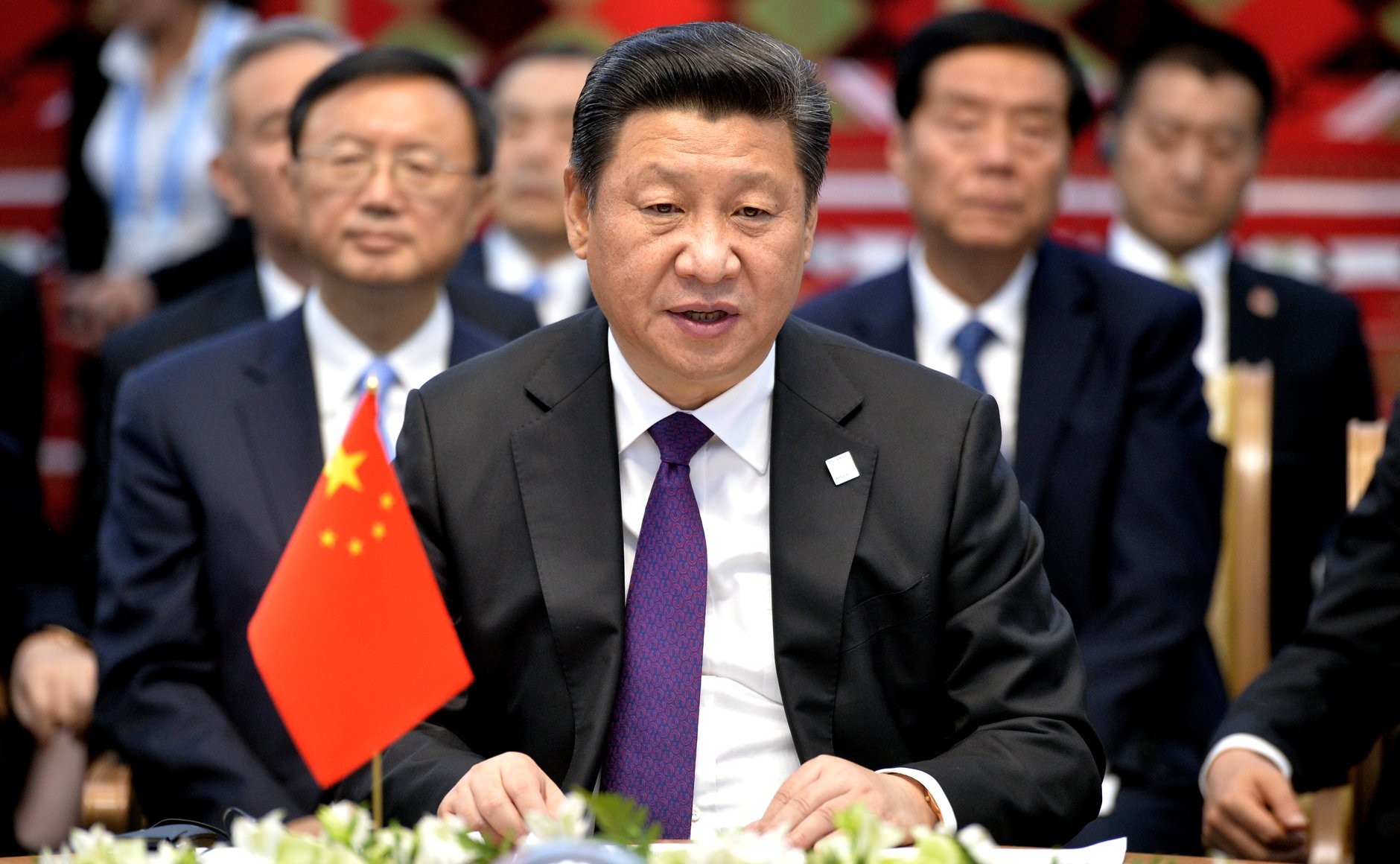

China needs to widen its commercial outlets, as it has been overproducing for some time, even though Xi Jinping has gone beyond the "natural laws" of capitalism to invest and artificially support the economy / Image: kremlin.ru

China needs to widen its commercial outlets, as it has been overproducing for some time, even though Xi Jinping has gone beyond the "natural laws" of capitalism to invest and artificially support the economy / Image: kremlin.ru

So we see how "Keynesian" policies are no longer having the desired effect even in China, in the only country that seemed to still have the financial resources to maintain them.

Beijing continues to have significant foreign exchange reserves (3.2 trillion dollars, even if this is down compared to 4.4 trillion a few years ago) and certainly has the largest banks in the world, although new clouds are gathering on the horizon.

In addition to the debt bubble, the real estate bubble and the protectionist measures of Trump, China is starting to have problems even with its allies that joined One Belt, One Road in recent years. Several of these countries have fallen into the classic "debt trap", and are indebted at levels that are no longer sustainable, including, among others, Malaysia, Pakistan, Myanmar, Sri Lanka, etc.

Malaysia recently cancelled $22billion of investments financed by China. Sri Lanka has asked the IMF for help. Pakistan is preparing to do the same, even though Mike Pompeo, US Secretary of State, has already declared that they will not give Pakistan a penny if this money goes to repay debts to China.

The pressures made by China to bring India into the project resulted first in the conflict in Bhutan, and more recently in the resumption of the conflict on the Kashmir border, with the killing of two Indian fighters by the Pakistani army.

There is now an increasingly stable alliance between the USA, India, Japan and Australia to limit Chinese expansion in Asia and the world.

The exhaustion of quantitative easing policies by the US Fed and the relative increase in interest rates on the dollar have caused a further shock for China, as capital is tending to flee the country. Already in 2015 the government's attempt to support the currency cost billions. On the other hand, accepting the devaluation would lead to new heavy internal contradictions (increases in interest rates and the cost of imports) and external contradictions (increased commercial tensions).

The rising level of tension with the US is revealed by changes in China’s foreign policy, which in the past had always been prudent, which is confirmed in the situation in Venezuela, where China has openly sided with Maduro.

They need commercial outlets through consolidating economic relations and finding new economic and political partners. This will bring them up against the interests of the US and also the European Union. That is why, beyond public declarations, commercial tensions are destined to remain and even deepen.

Working class and students: towards a Chinese ‘68?

As a result of the crisis, companies are starting to close in China, despite the state's efforts. Unemployment is growing (although this is not accurately recorded by the regime's statistics) and trade union disputes are on the increase.

The thing that worries the regime the most is that these disputes, which have been growing since 2008, are also starting to involve students. In Guangdong, the manufacturing centre of China and the world, about 50 students joined the workers of Jasic International at the end of July, and wanted to unionise legally under the ACFTU. The Jasic workers initially obtained permission from the ACFTU to unionise, but the latter then rescinded their permission which prompted the workers to enter into struggle. See our article: "China: JASIC workers' struggle reveals rising class tensions."

The workers

As soon as the students and workers gathered in a hotel in Huizhou, they were arrested by police in riot gear.

In major Chinese universities, students have stopped attending the official courses on Marxism (presented as "courses on the theory of economic development") since the autumn, while self-run courses have been organised on the crisis of overproduction and the class struggle.

The rector of Beijing University has threatened to close the student-run "Marxist society,” charging its members with developing a doctrine that aims to build links with the working class, instead of sticking to the orthodoxy of the Chinese Communist Party.

In Nanjing, two students were arrested in a demonstration against the non-recognition of the "Marxist Society" and, between November and December, 12 students mysteriously disappeared in Beijing, Shanghai, Guanzhou, Shenzen and Wuhan.

Students are beginning to link up with the working class, and are facing state repression / Image: JASIC WORKER SOLIDARITY

Students are beginning to link up with the working class, and are facing state repression / Image: JASIC WORKER SOLIDARITY

The government has hired thugs, who threatened and beat up the students who organised the search for their missing comrades. The university administrators have accused them of conducting "criminal activities."

The main reason why these students scare the regime so much is due to the fact that they come from elite universities. They are the children of the new Chinese ruling class and senior officials of the CCP bureaucracy.

These young people are gifted and influential; they were taught to consider themselves as neoliberals, thinking only of their own careers. They were supposed to compete with each other, and only think about how to make money and make their way through life. Then, at some point, they realised that, despite their efforts and sacrifices, they could not get the jobs they aspired to. And they have ended up rediscovering Marx.

What we are witnessing in China is a phenomenon very similar to what was seen in the French May ‘68 and in the Italian Hot Autumn [1969], where the children of the bourgeoisie and the petty-bourgeoisie turned to the factories in search of unity with the working class.

The difference, compared to back then, is not only the size of the phenomenon (China has a population of 1.4 billion and the most impressive industrial working class ever seen in history), but above all in the fact that the Chinese working class has no points of reference on the political and trade union level. They are young and much more educated than the first generation of workers that emigrated from the countryside in the early 1990s to work in the cities.

This second generation not only does not trust the ruling party, the CCP and the official unions, but tends towards organising independent unions, becoming the protagonist of uncontrollable mobilisations, with real outbursts of anger against the regime.

There is no mass communist opposition party in China today such as that of Marchais or Berlinguer, who in the 1960s and 1970s led the mobilisations in France and Italy down "reasonable" and reformist channels. Who can play that role in today's China?

A young man who organised one of the student Marxist societies was asked: "What are the causes of this return to Marxism among young people in China?" The answer was: "The government focuses on Confucianism, the extended family and nationalism, but this no longer works. Amongst the main causes for at least 20 percent of young Chinese people looking at Marxism, there are basically two: the slowing down of the economy and the revolutionary tradition of the country."

So, to answer the questions posed at the beginning of this article, we can say that China will enter the coming recession as a country that aspires to the leadership of world capitalism but which will emerge as an epicentre of a new revolutionary process, transforming Napoleon's hypothesis into the most earth-shattering and grandiose of realities.

[This is a slightly edited version of an article originally published in Italian here.]