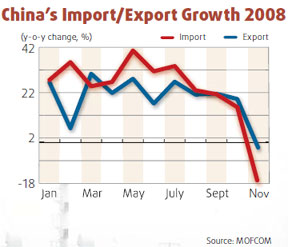

As the annual meeting of the Central Economic Work Conference closed in China a flurry of negative economic indicators were announced. In November, Chinese exports fell by 2.2% (after having recorded a growth of 19.2% in October), imports fell by 17.9% (compared to a growth of 15.6% in October). Foreign direct investment in China dropped by 36.52 percent in November to $5.3 billion, according to Ministry of Commerce figures. The Ministry of Finance announced that China's fiscal revenue dropped 3.1 percent in November from a year earlier, after having already fallen 0.3% in October. Construction of homes, offices and factories fell at least 16.6 percent in October after rising 32.5 percent a year earlier. Yet another indicator which shows the rapid slow down of the economy is power consumption which was down 3.7 percent year on year in October, the first year on year monthly decrease since 1999. Car sales dropped 10.3% from a year earlier in November, the third monthly decline this year. Finally, inflation fell to a 22-month low of 2.4% in November, raising the prospect of a deflationary spiral. This is just to mention a few of the bleak economic figures released in the last few days.

The speed at which the Chinese economy has been hit by the global crisis of capitalism is breathtaking, but if you analyse the reasons for it, it is hardly surprising. Over a long period of 30 years, the Chinese leadership has gradually embraced capitalism as they sought a way out of the impasse facing society as a result of the bureaucratic planning of the economy. In this process the Chinese economy became fully integrated into the world capitalist economy, becoming capitalist itself. Now it is facing its first capitalist crisis of overproduction.

Some of the dominant features of the Chinese economy, which have allowed it to grow at an unprecedented pace for a very long time, are its very high rates of investment, massive growth of exports and a large pool of skilled cheap labour. Now all these factors are turning into their opposite.

As the global economy enters into crisis, demand for Chinese products is drying up. The November fall of 2.2% in exports (which account for 40% of GDP) represents the first fall since June 2001 and the largest drop since April 1999 in the aftermath of the South East Asian crisis. During the 1990s China's exports grew at an annual average of 12.9%; from 2000 to 2006 that growth nearly doubled to 21.1% each year. Now Chinese exports have fallen in all of its markets, 6.1% to the US, and 2.4% to the ASEAN countries. This will have a serious impact both on the Chinese economy but also on the world economy, with exports contributing more than a quarter to total world economic growth. The recently released figures of the World Bank for the Chinese economy, which revised expected growth for 2009 to 7.5%, were based on a 4.2% rise in Chinese exports, but many economists now believe that there might not be any growth at all in exports.

As the global economy enters into crisis, demand for Chinese products is drying up. The November fall of 2.2% in exports (which account for 40% of GDP) represents the first fall since June 2001 and the largest drop since April 1999 in the aftermath of the South East Asian crisis. During the 1990s China's exports grew at an annual average of 12.9%; from 2000 to 2006 that growth nearly doubled to 21.1% each year. Now Chinese exports have fallen in all of its markets, 6.1% to the US, and 2.4% to the ASEAN countries. This will have a serious impact both on the Chinese economy but also on the world economy, with exports contributing more than a quarter to total world economic growth. The recently released figures of the World Bank for the Chinese economy, which revised expected growth for 2009 to 7.5%, were based on a 4.2% rise in Chinese exports, but many economists now believe that there might not be any growth at all in exports.

Qu Hongbin, the chief China economist at HSBC, said he expected things to get worse in the coming months and has suggested that exports could fall by 19 percent in the first quarter of 2009. "Combined with cooling property markets, this points to the rising risk of a hard landing," he said in a statement. "It's official: as the world's workshop, China will suffer as the global downturn deepens."

The Chinese toy industry which represents 70% of world toy production is already in deep trouble. According to the Chinese Customs Bureau, two thirds of all toy factories have shut down. In total, tens of thousands of factories have closed leaving hundreds of thousands, if not millions of migrant workers unemployed. Cao Jianhai, a researcher at the Chinese Academy of Social Sciences, was quoted in October as saying, "By the year's end more than 100,000 plants will have closed". Now this might be a conservative estimate. This manufacturing crisis has already led to a massive increase in strikes, worker protests and rioting, particularly, but not only, in the Pearl River Delta. Labour disputes almost doubled in the first 10 months of the year.

The fall in imports which has also been announced (17.9% year on year in November) is also worrying. It means that, as companies are closing down or unable to sell their products abroad, the demand for raw materials and components is drying up. This will have a massive impact on China's neighbours, which supply her. Amongst those which have already been badly affected are Taiwan, which sent almost 36 percent of its exports to China; South Korea, 25 percent; and Japan, 19 percent.

"China is a huge source of demand for commodities, and now its slowdown is a key reason behind the collapse of commodity prices," said Nicholas Lardy, a senior fellow at the Washington based Peter G. Peterson Institute for International Economics. "It's experiencing the sharpest deceleration of economic growth since reforms started 30 years ago." China is the world's biggest metals buyer and the second largest consumer of oil.

However, the crisis is not limited to toys or the export sector. As we have said, the other engine of the Chinese economy has been the very high rate of investment. This has been the case with the building of factories, infrastructure and housing for the rapidly growing urban population. Building is one of the biggest drivers of China's expansion, contributing a quarter of fixed asset investment and employing 77 million people. This led, like in most capitalist countries in the last period, to a housing and real estate bubble which has now burst. Some analysts calculate that house prices in Shangai fell by 20% in the third quarter of 2008 and official figures show that house prices nationally stalled at 0.2% in October. At the end of October, Yan Yu, a business management scholar at Peking University, was already warning: "House prices here in Dongguan have fallen by up to 50% this year," leaving many homeowners owing more on their mortgages than their homes are worth. According to Macquarie Securities, "construction will contract 30% next year after expanding 9 percent in the first three quarters of 2008."

The contraction of the building sector has affected the production of steel, cement and a whole series of related industries. Steel prices in China have already fallen sharply. According to Jing Ulrich, chairwoman of China equities at JPMorgan Chase & Co., spot "prices of hot-rolled sheet have plunged almost 40 percent since the end of June". Zhengzhou-based Bayannur Zijin Nonferrous Co. is reducing zinc output by 30 percent. The price of zinc, which is heavily used in the building and car industries has already collapsed by nearly 50% on the world market.

The contraction of the building sector has affected the production of steel, cement and a whole series of related industries. Steel prices in China have already fallen sharply. According to Jing Ulrich, chairwoman of China equities at JPMorgan Chase & Co., spot "prices of hot-rolled sheet have plunged almost 40 percent since the end of June". Zhengzhou-based Bayannur Zijin Nonferrous Co. is reducing zinc output by 30 percent. The price of zinc, which is heavily used in the building and car industries has already collapsed by nearly 50% on the world market.

It is the slowdown in production that is leading, as we have seen, to the danger of deflation, with prices in November growing only by 2.4%, the lowest rate in 22 months. The country's economic authorities have changed their approach from one of fighting inflation to one of attempting to prevent the devastating effects of deflation. "Declining prices, if they persist, generally create a vicious spiral of negatives, such as falling profits, closing factories, shrinking employment and incomes, and increasing defaults on loans by companies and individuals, all of which will aggravate the economic downturn," warned Dong Zhiging in the China Daily.

Effects on the world economy

Not so long ago, leading capitalist economists were arguing about decoupling, a theory that maintains that the "emerging economies" in the world would not be severely affected by a recession in the US and other advanced capitalist countries. In March this year, The Economist maintained that "recent data suggest decoupling is no myth. Indeed, it may yet save the world economy." However, reality is stubborn and now The Economist is forced to admit that China's "dreadful trade figures" are a "blow to the world economy". These figures, they say, "are particularly shocking because China's racing trade has been an engine of world trade, and thus global growth."

From a position of hoping against all reality that China would help soften the blow of the crisis of capitalism in the advanced capitalist countries, there is now a serious possibility of China helping to drag down world trade and with it world economic growth. This is leading to a growing conflict with the United States. The recent visit by US Treasury Secretary Henry Paulson only served to underline this. While the US is putting heavy pressure on China to revalue its currency in order to make Chinese exports less competitive in the US, it would be in the interest of the Chinese economy to devalue its currency, particularly after the recent export figures. The stage is set for protectionism and trade wars. In any case, it is not even clear that a devaluation of the yuan would help boost Chinese exports. Her neighbour South Korea has seen a devaluation of around 30% of her currency and still South Korean exports collapsed by 18% in November. Even if your products are cheaper, they are not going to be sold if there is no one out there to buy them!

Social consequences

The legitimacy of the Chinese leadership has been based over the last 30 years on their record of guaranteeing economic growth and increased living standards. Even though the capitalist reforms have meant the destruction of millions of jobs, appalling levels of exploitation for migrant workers moving to the cities, the partial destruction of the health care system, etc., all this could be sustained as long as the economy was growing, jobs were being created and living standards in general increased. However, if this is no longer guaranteed or is threatened by the slowdown of the economy, then the danger is that the already growing number of labour disputes and conflicts may turn into a generalised movement against the government, the state and the leadership of the CCP.

Zhang Ping, chairman of the National Development and Reform Commission, declared that: "excessive bankruptcies and production cuts will lead to massive unemployment and stir social unrest." Faced with this situation, the most challenging since the 1989 Tiananmen Square protests, by their own admission, the Chinese leadership has responded by implementing a series of measures, both economic and political.

Zhang Ping, chairman of the National Development and Reform Commission, declared that: "excessive bankruptcies and production cuts will lead to massive unemployment and stir social unrest." Faced with this situation, the most challenging since the 1989 Tiananmen Square protests, by their own admission, the Chinese leadership has responded by implementing a series of measures, both economic and political.

First of all, in order to limit the impact of workers' protests new instructions on police behaviour have been issued. The idea is to prevent small scale protests from escalating into massive riots or becoming generalised. Thus we saw in the recent taxi drivers' strike in Chongqing, how the authorities combined the stick with the carrot. While 20 striking drivers were arrested, the local party secretary Bo Xilai also met with a delegation of taxi drivers, made a whole series of promises and the discussion was broadcast live on the internet and TV. However, this change in tactics (less repression, more concessions in order to defuse tension) also carries its risks from the point of view of the authorities. As news of what was seen as a victory for the taxi drivers in Chongqing spread, taxi drivers in other cities also went on strike.

The state has also introduced new regulations to prevent mass redundancies. In the provinces of Hubei and Shandong, companies now need government approval if they are planning to make 40 or more workers redundant. "These measures can help protect social stability, which is now more important than economic development," said Liu Junsheng from the labour-wage institute of the Ministry of Human Resources and Social Security of Hubei, talking to the Changjiang Business Daily. However, it is difficult to see how this measure is going to have any real impact. Many of these small and medium sized enterprises are foreign-owned and their Korean, Taiwanese and other owners have often just closed shop without any prior notice and run away. Local municipalities have been ordered to ensure that workers receive proper redundancy payments and that unemployment benefit is made available to them. Regardless of how effective these measures will be in practice, they are very significant in understanding how worried the state apparatus is about trying to prevent unrest.

Unemployment is already rising, according to official figures. However, official statistics do not include all of the country's army of migrant workers (tens of millions of them) which in many cases are not registered to work in the urban areas and who are going to be the worst hit by the crisis. In an article in the China Economic Times on December 5th, capitalist hardliner Zhou Tianyong, economist of the Party School of the Central Committee of the Communist Party of China, predicts that China's real unemployment rate "could rise to as high as 14 percent next year". Zhou Tianyong also contends that the current rate of unemployment is already 12%, far above the official 4% figure.

Economic measures

On the other hand a number of economic measures have also been introduced. On November 9th, a massive government plan was announced, to spend an approximate US$586 billion, about 7% of GDP, over the next two years. This package includes infrastructure projects, but also investment in health, education and housing. However, as details were released, it became apparent that only about a quarter of this money was to be spent by the central government, and it was not clear how much of this money was new money, as opposed to other investment projects already agreed. Some economists have estimated that the impact of this stimulus package could be as much as 1% of GDP, and that it would only start to have an impact well into 2009. Looking at the more recent economic indicators, this may not be enough.

The government has followed up these measures by announcing tax rebates and tax cuts, and a cut in interest rates (the largest in 11 years). The aim of these measures is clear: to stimulate domestic consumption in order to make up for the fall in exports. The measures implemented in China are somewhat different to those adopted by Britain and the US for instance. While advanced capitalist countries have responded to the crisis by throwing money at the banks, in the hope that they will then start to lend to consumers, consumers will start to spend and thus the economy will be reactivated, in China what we have is a more classical Keynesian approach: a massive programme of public works, aimed at creating jobs, thus giving people money to spend, thus reactivating the economy.

The Chinese have one of the highest rates of savings anywhere in the world, and the thinking is that if they can get them to spend that money, then the economy will be boosted by its internal market. However, the main reason for these high rates of savings is the fact that the capitalist reforms destroyed or scaled-back the Iron Rice Bowl system of life-long secure employment and social welfare programmes that existed in the past. Now, the average Chinese household has to pay for a large part of their health, education, pension and other related costs. They are saving because they are terrified of getting sick, losing their jobs, getting old, and need to pay for part their children's education costs. If you add to this the effects of rapidly falling house prices which will hit the urban middle classes, and the risk of rising unemployment, the real impact of any Keynesian stimulus plan is likely to be limited.

The Chinese have one of the highest rates of savings anywhere in the world, and the thinking is that if they can get them to spend that money, then the economy will be boosted by its internal market. However, the main reason for these high rates of savings is the fact that the capitalist reforms destroyed or scaled-back the Iron Rice Bowl system of life-long secure employment and social welfare programmes that existed in the past. Now, the average Chinese household has to pay for a large part of their health, education, pension and other related costs. They are saving because they are terrified of getting sick, losing their jobs, getting old, and need to pay for part their children's education costs. If you add to this the effects of rapidly falling house prices which will hit the urban middle classes, and the risk of rising unemployment, the real impact of any Keynesian stimulus plan is likely to be limited.

It is true that China holds the largest foreign currency reserves of any country in the world (nearly US$3 trillion) and its debt is at a very low level (around 12% of GDP). This allows the Chinese authorities a certain room for manoeuvre to intervene in the economy and try to prevent the slowdown from turning into an outright recession. However, we should not forget that this position is similar to that of Japan in the 1990s, just before it entered a 10 year depression, despite the government spending massive amounts of money in infrastructure projects.

The picture that clearly emerges from looking at all these figures is one of a country where all the fundamentals that have driven the economy forward for the last few decades are now clearly turning into their opposite. China is facing a crisis of overproduction. There is too much capacity to build cars, toys, textiles, computers, houses, roads, fridges, steel, aluminium, cement... This massive capacity has been built on the basis of state investment in infrastructure and the export sector. This, like in any capitalist cycle, has reached its limits.

This is precisely what Marxists predicted. In April 2006, the International Marxist Tendency produced a draft document called "China's Long March to Capitalism". This is what we said at the time:

"Any significant decline in world markets would therefore drastically affect the growth of the Chinese economy, as happened to South Korea in the past. China is already facing the prospect of overproduction in steel, iron ore and coal, and also in consumer goods. The signs are there of a future crisis of overproduction.(...) This is inevitable, given the frenzy of investment in the country, where an incredible 45% of GDP is made up of investments, a level of investment which is historically unprecedented; not even Japan reached these levels during the post-war boom. So long as exports continue to grow and the west continues to get deeper into debt, they can live with this, but with this rate of growth in investment levels China is doubling its productive capacity every 4-5 years, a rate of growth that will inevitably lead to a massive crisis of overproduction."

Inevitably this economic crisis will have a massive impact on the consciousness of all layers in society. Above all the legitimacy of the leadership of the CCP, which has led the country to the restoration of capitalism, will be shattered. China's economic growth has created a fresh, multi-million strong, young working class and it has now started flexing its muscles. In the next period we will see ever wider layers of the Chinese working class enter the path of struggle.

For thirty years the Chinese workers have observed the leadership of the Communist Party gradually moving towards capitalism, seemingly without the interruptions in growth that we have observed periodically in the West. Now China is facing its first real recession, the Chinese workers will begin to see the other side of capitalist counter-reforms. In spite of everything they will see that the "market" is not the solution, but is actual the cause of the present crisis.

See also:

- Rural reform and revolt in China by Heiko Khoo (October 21, 2008)

- Healthcare in China - a victim of capitalist restoration by Vincent Wallace (October 2, 2008)

- China: 20 percent of China milk companies involved in melamine scandal by Fred Weston (October 1, 2008)

- China: Baby Formula scandal exposes flaws of the system by Matt Sumner (September 16, 2008)

- China's long march to capitalism by the International Marxist Tendency (July 2006)